The Basic Principles Of Finance Brokers Melbourne

Table of ContentsBest Financial Planners Melbourne for BeginnersThe Best Strategy To Use For Best Financial Planner Melbourne7 Simple Techniques For Melbourne Finance BrokerLittle Known Questions About Finance Brokers Melbourne.The smart Trick of Finance Brokers Melbourne That Nobody is Talking About

The mortgage brokerage firm industry is still new contrasted to the scenario in the US and the UK [] Not every one of the banks in Singapore are connected up with the home loan broker agent companies. [] The mortgage brokers are mostly regulated by the Singapore Legislation of Company. [] A research undertaken by Chan & Allies Consulting Team (CPCG) reveals that the home loan agenting industry is still mainly a brand-new concept to the Singapore financial consumers (melbourne finance broking). [] Nevertheless this will certainly set to alter as more consumers understand that taking up a real estate financing with the home loan broker does not boost the customer's expense at all, and can actually aid them in making a more educated choice. [] Mortgage brokers in the country do not charge customers any cost, instead earnings are made when the financial organizations pay the broker a payment upon effective financing dispensation by means of the broker's referral.When we say "obtaining ready to talk to a mortgage broker" you technically do not have to prepare a point. In claiming that, it's valuable to have a couple of things in mind so you can get the most out of your discussion.

Below are some inquiries you can ask yourself (and your partner if you're in it together - best financial planners melbourne) to obtain the ball rolling Do I desire to live in this property? Or get it as an investment? Where do I desire to live (and for how long)? What are my goals beyond residential or commercial property? What are my non-negotiables in a residential property? There's no responsibility to prepare inquiries, of training course.

Finance Brokers Melbourne Things To Know Before You Buy

At Finspo, we have over 30! Building inspector. These are all people you can have on your side a broker can explain what they do, when to call on them and exactly how they fit into your squad.

Finance Brokers Melbourne Fundamentals Explained

Yet hey, we will not go tooooo deep at this stage. Oh, sorry, that's simply Luke. Of all, make certain you leave the meeting feeling great recognizing you've begun the conversation that a lot of people often find daunting. What happens next is entirely up to YOU. With Finspo, you can move as quick or sluggish as you like.

Be careful of estimated provided by your home mortgage broker that they have been given by the lender. Price quotes are not lawfully binding and it is necessary to completely understand the actual home mortgage terms before finalizing. If you already have a lengthy and positive relationship with strong relationship with an economic establishment, you may be able to obtain a good deal straight from a financing police officer at the bank.

Melbourne Finance Broker - The Facts

With a lot of bargains from a selection of lending institutions, home loan brokers have the capability to search but being conscious of a commitment supplies from your own bank makes feeling. Home mortgage brokers are terrific at searching for the very best offers but the truth is that some major financial institutions favor not to do company with outside brokers.

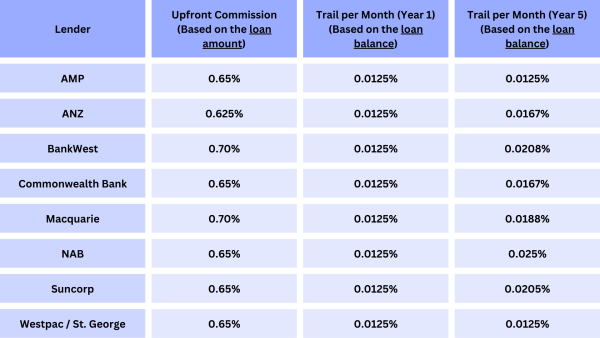

Right here are some ways you can pick the finest broker to function with: Ask for recommendations from relatives, friends, or your realty agent Check their credentials and specialist associations Explore online customer check it out reviews Validate their costs and commissions.

When it involves getting a home mortgage, Australian customers aren't doing not have in choices. There are well over 100 financial institutions and other lenders currently operating the market offering countless various mortgage items. Looking with that sea of choices to discover a suitable mortgage and after that browsing the funding application process can be an overwhelming job though, particularly for new customers.

The Best Strategy To Use For Melbourne Finance Broker

Rather of someone going directly to the financial institution to get a funding, they can go to a home mortgage broker that will certainly have access to a lot of various loan providers - frequently a panel of as much as 30 various loan providers."The first thing they truly do is analyze a client's requirements, due to the fact that everyone's going to be various.

With a broker, you could be missing out on out on a particular sub-sector of the borrowing market that can usually have the ideal bargains."That's not to say that brokers can't help their customers conserve money on their home mortgage in various other methods.